Modular Multi-family Construction: A Field Study of Energy Code Compliance and Performance through Offsite Prefabrication

Kevin Grosskopf is a professor at the University of Nebraska-Lincoln

Prefabrication in a factory setting may improve the performance of modular buildings compared to traditional site-built buildings. To validate this premise, the U.S. Department of Energy (DOE) funded a 3-year study from 2020-2023 comparing the energy performance of more than 50 modular and site-built multifamily buildings under construction in Los Angeles, San Francisco, Philadelphia and Seattle. In addition to energy performance, DOE was also interested in the potential cost savings of modular construction as well as other market opportunities and challenges.

Crane set at a modular jobsite (VBC), Philadelphia PA, 2022. 260,000 sq. ft. mixed-use project consisting of 5-stories and 410 residential modular units over 2-stories of site-built commercial podium.

Part I - Energy Performance

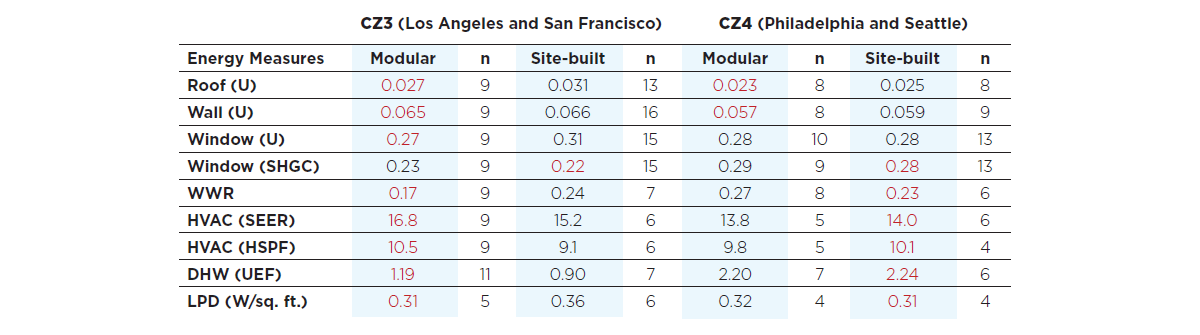

Multifamily buildings selected for this study averaged 6 stories, 140,390 sq. ft. square-feet and 144 units. Data was collected on several energy-related material and equipment systems. Data collection for each project began with a plan review followed by two field inspections. For modular projects, the first inspection was conducted at the factory and a second inspection was conducted at the construction site. Findings indicate that the performance of key energy-related materials and equipment in modular multifamily construction was somewhat better than those found in site-built, particularly in climate zones 3 (Los Angeles and San Francisco).

The DOE study also looked at the post-occupancy energy performance of another 20 modular multifamily buildings completed between 2013-2022 in these same areas. While there appeared to be little difference between the annual energy use in modular multifamily buildings (36.0 kBtu/sq. ft./yr) compared to more than 120 site-built buildings (35.8 kBtu/sq. ft./yr), ENERGY STAR™ scores for modular (86) were higher on average compared to site-built (81).

Given that most of the modular buildings in this study were affordable housing, apartment units were smaller on average (560 sq. ft.) compared to site-built units (830 sq. ft.). As a result, occupant density in modular multifamily buildings was 30-50% higher. When normalized for this, the energy performance of modular multifamily construction is likely (much) better than site-built. Although few differences were observed between the types of materials and equipment used in either modular or site-built multifamily construction, installation quality appeared to be significantly better in modular.

Part II - Market Opportunities & Challenges

During factory and construction site inspections, interviews were conducted with project stakeholders to identify key market implementation opportunities and challenges. Findings suggest that the most significant advantage of modular construction is schedule savings. Offsite prefabrication can proceed simultaneously with onsite construction, reducing time, project overhead and the impact of weather. Overall, modular buildings in this study were completed 25-30% faster on average when compared to site-built buildings. Despite added transportation costs, modular construction ($243/sq. ft.) was also found to be cost-competitive with site-built construction ($251/sq. ft.), particularly when considering shortened construction schedules and speed to market.

Yet, persistent barriers to modular market growth remain, including a building industry that is unwilling to change from traditional site-built methods, consideration of modular too late in the design process, lack of modular industry standards, and the risks associated with modular builders as a very large suppliers or subcontractors in the design-bid-build delivery process.

To address these issues, some manufacturers have undertaken a greater role in the design-manufacture-construct process. Specifically, manufacturers have begun to offer ‘turn-key’ building solutions by providing design, manufacturing and construction services in-house. By doing so, a commitment to modular is made at the beginning of the project, saving time and money. The inefficient, even adversarial relationship between designers, manufacturers, and site contractors is replaced with a single, fixed-price contract between developer and manufacturer before production begins. Profits are tied to overall project performance, not to the performance of individual players in the traditional design-bid-build process.

Production line at a modular factory (Nashua Builders), Nampa ID, 2023.

Conclusion

With greater control over the project design, as well as the number and timing of projects undertaken, modular manufacturers in the design-manufacture-construct process can better achieve product standardization within their factories and sustain production between project cycles. In doing so, factories can be operated more efficiently with less worker turnover.

Download the Complete Report

Download a complete copy of Kevin Grosskopf's 2023 report "Modular Multi-family Construction: A Field Study of Energy Code Compliance and Performance through Offsite Prefabrication"

More from Modular Advantage

AoRa Development Aims for New York’s First Triple Net Zero Building Using Modular Methods

More cities are providing funding for newer infrastructure projects as long as they meet sustainability requirements. This is how modular can fit the bill, thanks to its lower waste production.

Developers and Designers: Lessons Learned with Modular Design

Modular construction is attractive to many developers because sitework and module construction can occur simultaneously, shortening the schedule and reducing additional costs.

UTILE: Putting Modular Building on a Fast Track

In Quebec, UTILE is taking the lead in creating affordable modular buildings to help decrease the student housing shortage. During the process, the company discovered what it takes to make the transition to modular building a success.

Sobha Modular Teaches Developers How to Think Like Manufacturers

With its 2.7 million square foot factory in UAE, Sobha Modular is bringing both its high-end bathroom pods to high-end residences to Dubai while developing modular projects for the U.S. and Australia.

RoadMasters: Why Early Transport Planning is Make-or-Break in Modular Construction

In modular construction, transportation is often called the “missing link.” While it rarely stops a project outright, poor planning can trigger costly delays, rerouting, and budget overruns.

Navigating Risk in Commercial Real Estate and Modular Construction: Insights from a 44-Year Industry Veteran

Modular projects involve manufacturing, transportation, and on-site assembly. Developers must understand exactly what they are responsible for versus what they subcontract. Risk advisors should research the developer’s contractors, subcontractors, and design-build consultants—especially the modular manufacturer.

Art²Park – A Creative Application of Modular and Conventional Construction

Art²Park is more than a park building—it’s a demonstration of what modular construction can achieve when thoughtfully integrated with traditional materials. The use of shipping containers provided not only speed and sustainability benefits but also a powerful structural core that simplified and strengthened the rest of the building.

Building Smarter: A New Standard in Modular Construction Efficiency

Rising material prices, labour shortages, expensive financing and tightening environmental rules have made conventional construction slower, costlier, and more unpredictable. To keep projects on schedule and within budget, builders are increasingly turning to smarter industrialized methods.

Resia: Breaking All the Rules

Resia Manufacturing, a division of U.S.-based Resia, is now offering prefabricated bathroom and kitchen components to industry partners. Its hybrid fabrication facility produces more precise bathroom and kitchen components (modules) faster and at lower cost than traditional construction. Here’s how Resia Manufacturing does it.

How LINQ Modular Innovates to Bring Modular To The Market in the UAE and Beyond

LINQ Modular, with an office and three manufacturing facilities in Dubai, is a modular firm based in United Arab Emirates. The company is on a mission: to break open the housing and construction markets in the Gulf Cooperation Council (GCC) area with modular.