By the Numbers

Assessing MBI Member Training, Professional Development & Workforce Needs

Heather Packard is the Workforce & Professional Development Director for the Modular Building Institute

As part of MBI’s continuing efforts to expand the footprint of the commercial modular construction industry, we launched an intelligence gathering process in mid-September 2023 to collect information on member companies’ challenges and needs with respect to training, professional development, and workforce. The purpose of this process was to identify critical needs to support development of a near- and long-term strategy to address these needs.

Intelligence Gathering Process

The intelligence gathering process included two phases: a qualitative phase consisting of one-on-one conversations with representative member companies and a quantitative phase consisting of a survey instrument distributed to all MBI contacts.

To ensure a representative set of data for the first, qualitative, phase, conversations were held across member company types including manufacturers (5 direct and 3 wholesale), dealers/fleet owners (3), owners/developers (2), contractors/builders (3), design professionals (3), suppliers of services (1), and suppliers of materials (2).

This phase probed challenges member companies are experiencing at an industry-wide, company-specific, and partner-specific level as well as ideas on how MBI could support attracting new entrants to our industry along with training and professional development opportunities for staff.

Visualized results from one question of MBI's Workforce and Professional Development survey from September 2023.

Qualitative Outcomes

Challenges at an industry-wide level uncovered during the qualitative phase included labor – limited supply of skilled tradespeople as well as experienced architects, engineers, and project managers – along with a lack of stakeholder awareness of modular capabilities, including clients, architects, and financial institutions.

Company-specific challenges also included labor – difficulties in attracting tradespeople, backfilling at mid and senior levels, and small talent pools for design, drafting, estimating, and purchasing – along with market supply and demand and finding new areas of growth.

Partner-specific challenges uncovered insufficient production capacity at the manufacturer level and a need for increased awareness and education amongst stakeholders including developers, lenders, building inspectors, general contractors, and clients.

Training and professional development ideas discussed included opportunities to leverage Introduction to Commercial Modular Construction for employee on-boarding and developing training for commercial modular set and install staff, sales staff, project management staff, and market-facing individuals. The one-on-one conversations also uncovered a need for building code-based training and refreshers for MBI member companies, government officials, and financial institutions.

Ideas for attracting new entrants centered on increasing youth awareness of the commercial modular construction industry’s opportunities and advantages over traditional construction. These discussions included potential outreach and engagement opportunities directed towards high-school level groups promoting trades and with vocational technology centers in an effort towards increasing the future talent pipeline for labor and trades. Outreach and engagement with universities offering a construction-related degree was another hallmark of these conversations, with a goal towards increasing university program curriculum focus on modular in the hope that this could lead to better-trained and more well-rounded future designers, architects, engineers, and project managers.

Quantitative Phase

We used a survey instrument for the second, quantitative, phase, which was distributed to all MBI contacts. To date, we have received responses from 68 unique organizations across all MBI membership categories and affiliations, a roughly 12% response rate. The survey instrument addressed the following topics:

- Estimated workforce needs over the next 1-3 years

- Most difficult roles to fill within the past 1-2 years

- Longest time it has taken to fill vacant roles

- Most useful recruiting methods

- Educational topics of interest

- Learning format preferences

Quantitative Outcomes: Estimated Workforce Needs

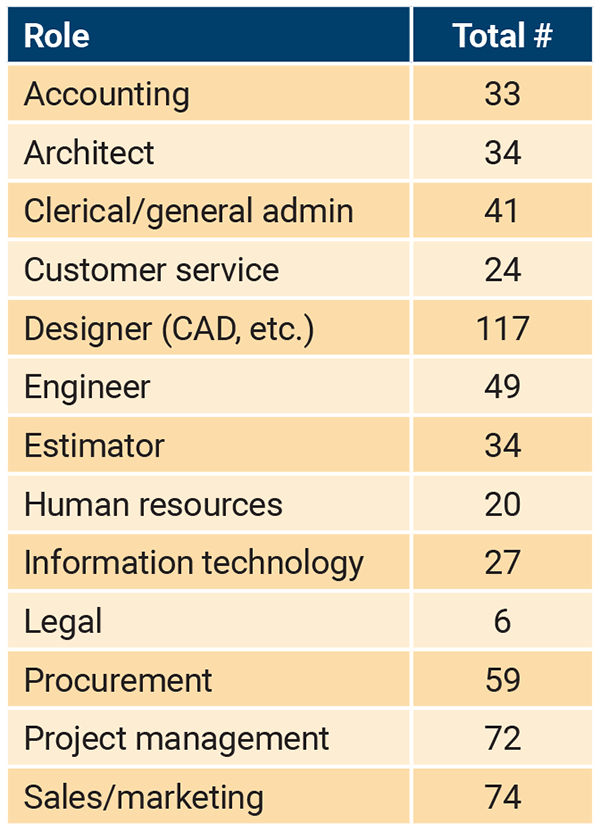

Current responses to estimated workforce needs across administrative and office professional staff demonstrate a near-term (next 1-3 years) need for the following roles:

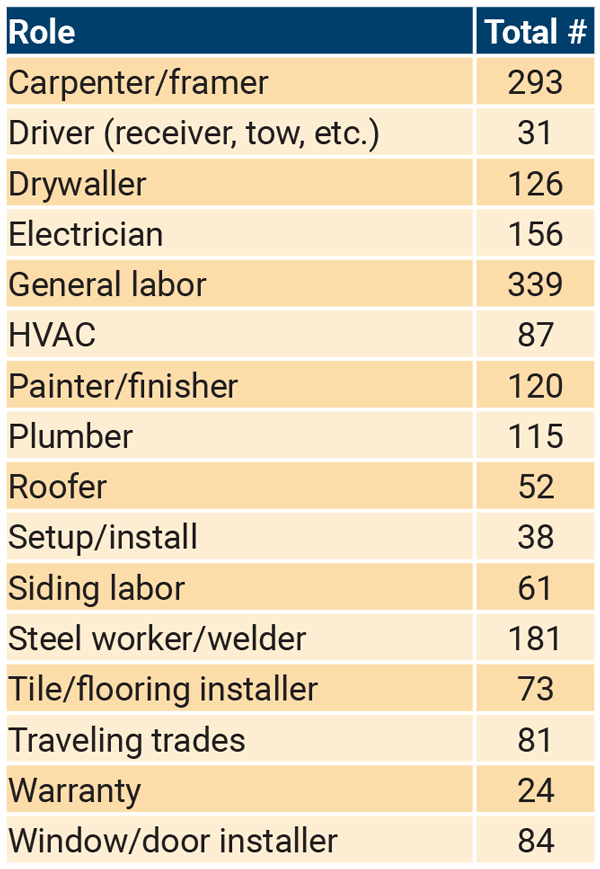

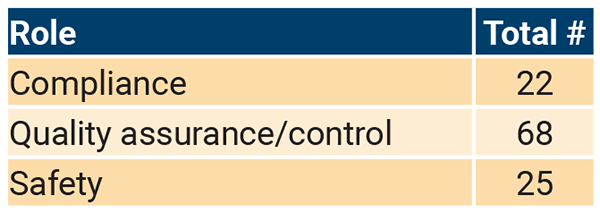

Current responses to estimated workforce needs across labor, trades, and delivery staff demonstrate a near-term (next 1-3 years) need for the following roles:

Current responses to estimated workforce needs across safety, compliance, and quality assurance/control staff demonstrate a near-term (next 1-3 years) need for the following roles:

Quantitative Outcomes: Most Difficult Roles to Fill, Longest Time to Fill Vacant Roles, and Most Useful Recruiting Methods

The most difficult roles to fill within the last 1-2 years echoed the small talent pools uncovered in the first, qualitative, phase, and included tradespeople of all types, general and skilled labor, carpenters/framers, drywall finishers, experienced production and plant workers, architects, designers, engineers, and project managers – with experience in modular – as well as drafters, BIM experts/managers, sales professionals, customer service, and estimators.

Responses to the longest time to fill vacant roles further demonstrate the talent shortage our industry is experiencing. Roles for CAD operators and designers, electricians, plumbers, welders, and quality control staff were reported to take greater than 1 year to 2 years to fill.

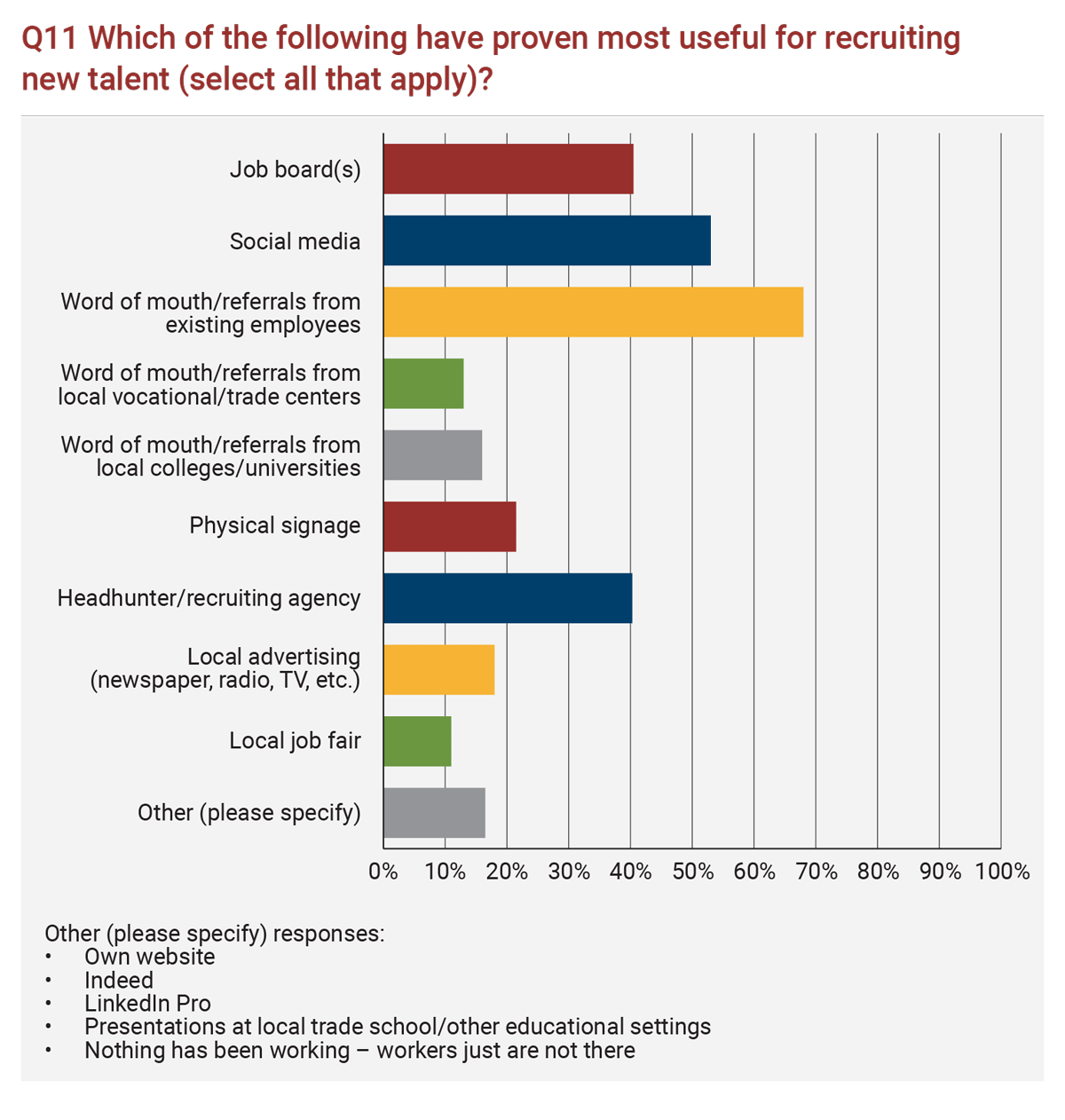

Members reported word of mouth and referrals from current employees as the most useful recruiting method, followed closely by social media efforts and job boards (typically Indeed for labor and trades). The full list of recruiting methods, their current rankings, and responses to “other, please specify” is below.

Quantitative Outcomes: Topics of Interest and Learning Format Preferences

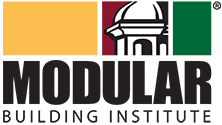

In terms of learning topics of interest, members reported an interest in regulatory topics including building codes and permitting, best practices in the industry, design and engineering, research and innovation, project scoping, execution and management, planning for growth and expansion, and quality assurance and control. The full list of learning topics of interest and their current rankings is below.

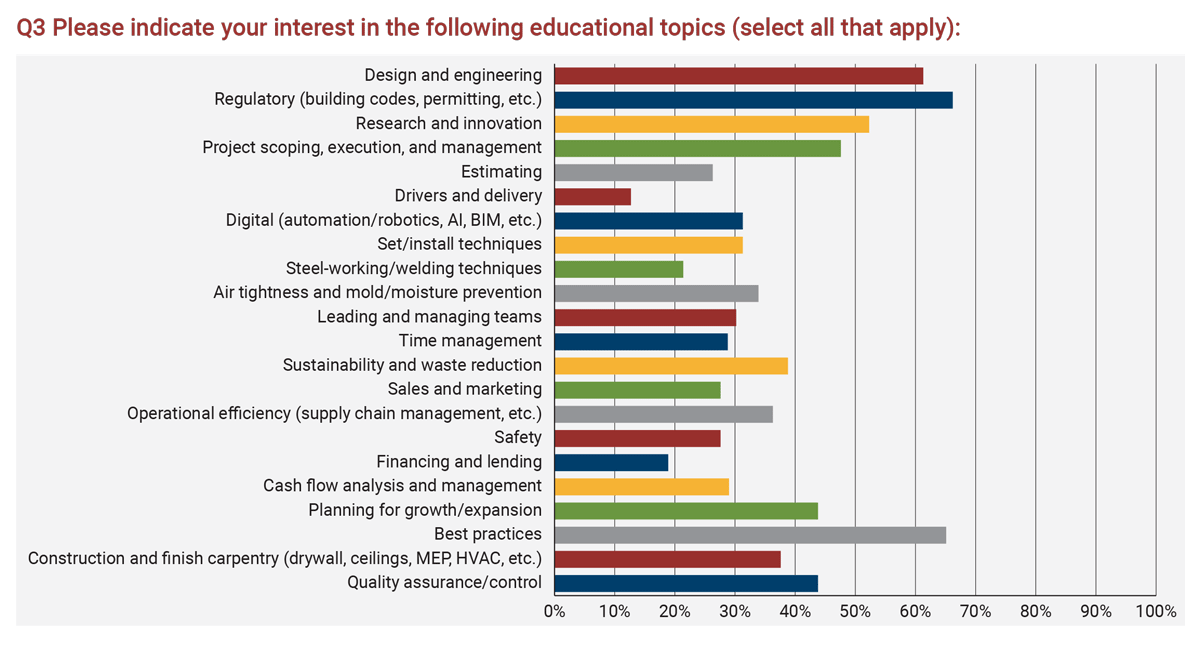

Lastly, members expressed a preference for live webinars, live in-person events, video recordings with slides and transcripts, and self-paced online courses. The full list of learning formats and their current rankings is below.

Make Your Voice Heard

The survey instrument will remain open so that we can continue to collect member needs and preferences and take these into account for further strategy development and execution. Please visit MBI's online survey and make your voice heard!

If you have any questions about the process or have other feedback or suggestions for MBI to consider, please contact Heather Packard, Professional & Workforce Development Director, at heather@modular.org.

More from Modular Advantage

AI, Faster Sets, and Automation: The Future of Modular is at World of Modular

While the modular building industry has long known that it can be an effective solution to increase affordable housing, the word is slowly spreading to more mainstream audiences. Three presentations at this year’s World of Modular in Las Vegas hope to provide insight and direction for those seeking a real solution to the crisis.

An Insider’s Guide to the 2025 World of Modular

The Modular Building Institute is bringing its global World of Modular (WOM) event back to Las Vegas, and with it comes some of the industry’s best opportunities for networking, business development, and education. Over the course of the conference’s four days, there will be numerous opportunities for attendees to connect, learn, and leverage event resources to get the most out of the conference.

Affordable Housing Now: The Industry’s Best Bring New Solutions to World of Modular

While the modular building industry has long known that it can be an effective solution to increase affordable housing, the word is slowly spreading to more mainstream audiences. Three presentations at this year’s World of Modular in Las Vegas hope to provide insight and direction for those seeking a real solution to the crisis.

Opportunities for Innovation in Modular Offsite Construction

Modular Offsite Construction has already shattered the myth that it only produces uninspired, box-like designs. Architectural innovations in module geometry, configurations, materials, and products make it possible to create visually stunning buildings without sacrificing functionality or efficiency.

Safe Modular Construction with Aerofilm Air Caster Transport

In collaboration with Aerofilm Systems, Heijmans developed innovative skids using air caster technology for moving modules easily and safely. These pallets are equipped with an auto-flow system, making operation extremely simple.

Miles, Modules, and Memes: Building a Modular Network One Flight at a Time

At the end of the day, social media is just another tool for building connections, and like any other tool, needs to be used skillfully to work properly. Use social media thoughtfully, and it will open doors to real opportunities and relationships you didn’t even see coming.

Falcon Structures: Thinking Inside the Box

Some of Falcon’s latest projects include creating container solutions for New York’s Central Park and an East Coast professional baseball team. More and more, Falcon is shipping out container bathrooms and locker rooms to improve traditionally difficult work environments, like those in oil and gas or construction.

UrbanBloc—From Passion to Industry Leader

UrbanBloc specializes in three main categories or markets – what they call “Phase 0” projects, amenities, and urban infill. Clients are often attracted to shipping containers because from a real estate perspective they are considered an asset. Having the flexibility to move and transport these assets allows owners to respond to different circumstances in a fluid manner that they can’t get with standard construction.

The Hospitality Game-Changer

“Hospitality is about more than just providing a service – it’s about delivering an experience,” says Anthony Halsch, CEO of ROXBOX. “And that’s where containers thrive. They allow us to create spaces that are unique, efficient, and sustainable.”

Container Conversions Counts on Simplicity to Provide Critical Solutions

Container Conversions has fabricated and developed thousands of containers for varied projects, including rental refrigeration options, offices, kitchens, temporary workplace housing, and mobile health clinics.