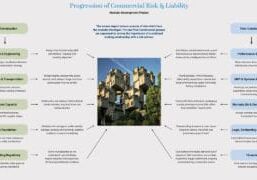

Navigating Insurance Challenges in the Modular Construction Industry

Daniel Seltzer, CPCU, is Senior Risk Advisor at RCM&D.

Despite three recent reports from McKinsey & Company (May 2023), Fortune Business Insights (July 2023), and Gitnux (April 2024) highlighting substantial benefits of permanent modular construction—such as 20-50% less time and 15-25% less cost—North American demand for permanent modular construction surprisingly lags behind. With only 4% of total housing starts in the United States, compared to 15% in Japan, and 45% in Scandinavian countries, one can’t help but wonder—why the stark difference? Is culture a determining factor?

My professional career started with a unique training program in 1981 with a global insurer working on Wall Street and Boston, followed by a year of “running slips” on the floor of Lloyd’s of London. Since 1985, I have been a fiercely independent insurance advisor/broker in the industry. After 43 years in this business, I am having fun with “modular” risk since most brokers fail to identify the unique risks inherent within the industry, and insurance companies have yet to promulgate reliable loss statistics for this evolving marketplace. Most price insurance for “Manufacturing” or “Home Builder” risk, where the result can create serious coverage gaps, fine-print exclusionary wording, and insurance policies which do not align with the actual plant then transit then site exposures.

From a risk management and insurance perspective, I have reviewed the property and casualty insurance policies for members of the Modular Building Institute (MBI). Almost without exception, coverage concerns were identified, and in most cases, gaps in coverage were present, including exclusionary wording found within the fine-print of the nearly 100-page policies.

Usually, the insurance broker is at fault, or maybe the insurance carrier added an incorrect form to the policy, and sometimes, the “modular” professional does not invest adequate time in the design and implementation of their insurance program. In this article, I offer only a few observations for the purpose of helping the modular building entrepreneur to become a more complete purchaser of commercial insurance, with the goal being to protect the business and family lifestyle.

1. “Use & Occupancy” (aka Business Interruption) Coverage

To assure you consider the correct type of Business Insurance and amount of protection, a few things must exist. Your insurance broker must be an expert on the subject, and the modular operator must feel comfortable answering their questions.

The following questions are on-point, for example:

- If your plant was destroyed, would you rebuild, and if applicable, would you want rental payments to continue for your family? Of if you lease, do your lease obligations abate?

- How quickly would you need to be back in business? And why?

- If your plant was in pre-loss condition in nine months, would your clients return?

- While down, how much money would you need to maintain revenues, and how would you deploy such funds if they were made available?

- Can we invest time together to lay out a plan?

- Whatever functions were interrupted, could you source these steps to another company or a competitor? At what additional costs?

- Should we consider formulating a reciprocity agreement with another operator?

If your broker has not asked you these questions, please find another broker.

2. Errors & Omissions (aka Professional Liability Insurance)

Attending the WOM Convention and during almost every break-out session at the Offsite Construction Summits, I hear about engineering, approvals, codes, and how essential the planning process is to a successful project. This points directly to the importance of well-crafted contracts, working with experienced pros, considering Errors & Omissions (E&O) and understanding its potential benefits and limitations. “Per Project” insurance was affordable and readily available in the old days, but for the last several years, “Practice” policies are the norm. There are two facts you must be familiar; first, the engineer’s, architect’s or other design-build consultants policy limits apply to all their customers and are NOT only for your contract, and second, in 90% of the cases, these same limits extend back into time to the date of the first time they purchased E&O insurance. This is known as the “retroactive date.”

For illustrative purposes, your agreement with Y3TmX Engineering, Inc. requires maintaining $1,000,000 Professional Liability, and they present a certificate of insurance (COI). The $1,000,000 per accident or Wrongful Act limit is available to all current clients and all prior projects, completed or on-going. If they show a retroactive date of June 15, 2007, this same $1,000,000 is available for all projects Y3TmX Engineering was/is engaged reaching back over 15 years.

If your broker has not discussed this with you, or if they have yet to propose viable risk management techniques to protect your balance sheet, please carefully choose another broker.

3. Incorrect General Liability Classification

With over 325 business types to choose from, underwriters price General Liability, including Products Liability, utilizing rates (pure loss rate + other charges) promulgated by their actuaries and third-party advisory services (mostly ISO) given historic loss levels as a percentage of sales, payroll, or area.

Since the permanent modular construction industry is a relative newcomer to this country, and the multitude of industries being built to support the sector are so varied, the General & Excess Liability insurance policies crafted by over 750 insurers, I strongly suggest your policy be evaluated by an expert. What you do not want is a contract to an argument. Post-loss or after litigation commences, is not the time to learn about coverage deficiencies. Although not an adversary, the insurance carrier wrote the insurance policy (contract) language, and they did so with their interests being number one. The playing field should be tilted in your favor as much as possible pre-loss.

Prior to becoming a client, one such modular operator was previously insured by a carrier who was only aware of their manufacturing, and not their contracting operations. The coverage was limited to their single plant location, and losses arising from transit or contracting activities were specifically excluded.

Are you certain your coverage does not contain warranties, restrictions, or limitations with which you are not familiar?

4. Possession or Bill of Lading

The “simple solution” I reference is not complex like high school organic chemistry or collegiate-level calculus, but it does require thought, experience, and a deep understanding. Knowledge surrounding frequency, values, conveyance types, purchase orders, and precedence. Insurance carriers are accustomed to insuring raw materials, finished stock, and goods in transit, or materials located in a temporary warehouse or a manufacturing plant. It is to the advantage of the insurance company to charge premium and then exclude or limit their exposure when possible.

Just because your incoming Bill of Lading indicates FOB Destination (your plant), and your outgoing Bill of Lading is FOB Shipping Point (your plant), does not mean you are protected. For example, the on-site general contractor calls asking about the status of your $173,000 shipment. You are shocked since it was released last Monday. The shipper indicates a problem came up, and the shipment is missing or damaged. Your BOL releases you from liability, but your client (project owner) is not happy, and the general contractor is now going to deliver three weeks late.

Negotiate property coverage to extend to your interests, and that of your customers, if there is no other valid and collectible insurance? If this is not in place for your company currently, we can help.

5. Risk Transfer

a term used frequently by licensed insurance brokers, many of whom do not support their clients’ needs A through Z. What do I mean by “Risk Transfer?” The party holding themselves out as a professional and being paid to perform specific tasks should be responsible for assuming risk and pre-funding exposure to loss created by or arising from their actions, omissions or services. For true risk transfer to take place, applicable contracts must be studied and coordination with counsel must occur. Unless licensed to provide legal guidance, the insurance broker should not supply final indemnification language without being clear of the need for legal counsel approval.

95% of insurance brokers I speak with are not up to speed on the subject of Additional Insured. In 1985 and again in 2013, substantial changes were made by the insurance industry. Utilizing antiquated contract language (purchase orders, leases, partnership agreements, loan covenants, etc.) will not accomplish risk transfer. Note, the benefits of being an Additional Insured are not realized by simply receiving a certificate of insurance which states you are Additional Insured.

The solution – utilizing practical written minimum insurance and indemnity requirements, along with monitoring certificates of insurance by someone who has COI training will not yield a perfect risk transfer strategy, but the exposure will be managed much better than it is currently.

More from Modular Advantage

AoRa Development Aims for New York’s First Triple Net Zero Building Using Modular Methods

More cities are providing funding for newer infrastructure projects as long as they meet sustainability requirements. This is how modular can fit the bill, thanks to its lower waste production.

Developers and Designers: Lessons Learned with Modular Design

Modular construction is attractive to many developers because sitework and module construction can occur simultaneously, shortening the schedule and reducing additional costs.

UTILE: Putting Modular Building on a Fast Track

In Quebec, UTILE is taking the lead in creating affordable modular buildings to help decrease the student housing shortage. During the process, the company discovered what it takes to make the transition to modular building a success.

Sobha Modular Teaches Developers How to Think Like Manufacturers

With its 2.7 million square foot factory in UAE, Sobha Modular is bringing both its high-end bathroom pods to high-end residences to Dubai while developing modular projects for the U.S. and Australia.

RoadMasters: Why Early Transport Planning is Make-or-Break in Modular Construction

In modular construction, transportation is often called the “missing link.” While it rarely stops a project outright, poor planning can trigger costly delays, rerouting, and budget overruns.

Navigating Risk in Commercial Real Estate and Modular Construction: Insights from a 44-Year Industry Veteran

Modular projects involve manufacturing, transportation, and on-site assembly. Developers must understand exactly what they are responsible for versus what they subcontract. Risk advisors should research the developer’s contractors, subcontractors, and design-build consultants—especially the modular manufacturer.

Art²Park – A Creative Application of Modular and Conventional Construction

Art²Park is more than a park building—it’s a demonstration of what modular construction can achieve when thoughtfully integrated with traditional materials. The use of shipping containers provided not only speed and sustainability benefits but also a powerful structural core that simplified and strengthened the rest of the building.

Building Smarter: A New Standard in Modular Construction Efficiency

Rising material prices, labour shortages, expensive financing and tightening environmental rules have made conventional construction slower, costlier, and more unpredictable. To keep projects on schedule and within budget, builders are increasingly turning to smarter industrialized methods.

Resia: Breaking All the Rules

Resia Manufacturing, a division of U.S.-based Resia, is now offering prefabricated bathroom and kitchen components to industry partners. Its hybrid fabrication facility produces more precise bathroom and kitchen components (modules) faster and at lower cost than traditional construction. Here’s how Resia Manufacturing does it.

How LINQ Modular Innovates to Bring Modular To The Market in the UAE and Beyond

LINQ Modular, with an office and three manufacturing facilities in Dubai, is a modular firm based in United Arab Emirates. The company is on a mission: to break open the housing and construction markets in the Gulf Cooperation Council (GCC) area with modular.