Now for 2024

Looking Back & Forward

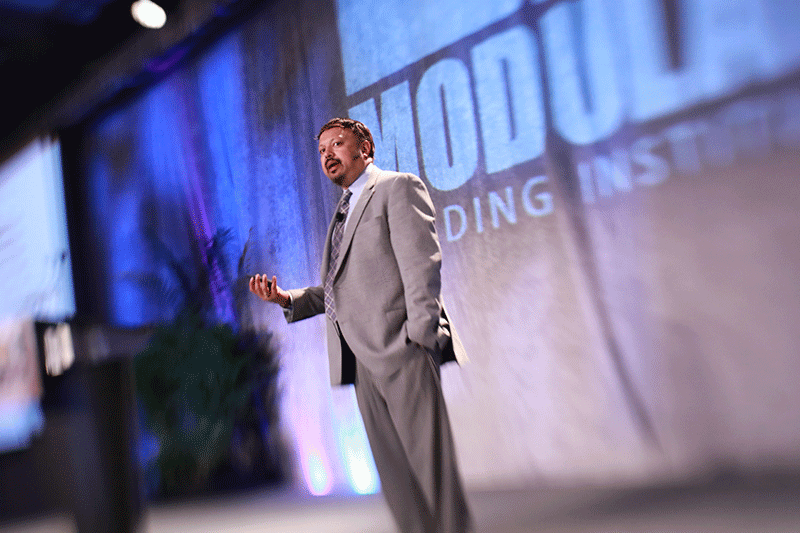

Anirban Basu is the Chairman & CEO of Sage Policy Group and Chief Economist of the Modular Building Institute.

Looking Back

Coming into 2023, economists could be considered an arrogant lot. Normally, forecasting economic activity is a humbling experience. But this year was set to be different. Recession was all but assured given the Federal Reserve’s aggressive anti-inflation campaign – one associated with the fastest interest rate increases in more than four decades. After a period of euphoric, inflation-soaked recovery from the early stages of the pandemic, the economy was due for a setback.

Economists were not alone. Surveys of U.S. executives conducted in late-2022 indicated that business leaders were also convinced that recession was on the way. Many firms indicated an intention to reduce full-time headcount in anticipation of 2023’s downturn, a way to preserve quarterly profits even as demand for goods and services began to dry up.

Alas, economists are even more humble now. Rather than entering recession, the economy has powered through both lingering excess inflation and higher interest rates. Equity markets have rallied.

Anirban Basu speaks at MBI's annual World of Modular conference and tradeshow.

Employers have hired. The unemployment rate has remained neatly below 4 percent, and stands at below 3 percent in many major metropolitan areas. Even home prices, which were expected to give back much of their pandemic-era gains, have been climbing recently.

Indeed, rather than slow down, the economy has been gathering steam as the year has progressed. During the first quarter, U.S. gross domestic product expanded 2.0 percent. The next quarter ushered forth an equally satisfying 2.1 percent performance. For much of the third quarter, the economy has been on pace to expand at a faster than 3 percent rate. None of this are indicia of recession. Consumer spending continues to drive activity forward. So, too, does the current era of the megaproject, with construction firms benefitting from surging infrastructure and industrial construction as the federal government continues to pour monies into the economy and as supply chains return to America with fury.

The ability of the U.S. economy and its interest rate sensitive construction sector to power through a period of weak global growth, bank failures, and higher borrowing costs has been simply mystifying. Capitulating to ongoing momentum, many economists have simply dropped their recession forecasts, including economists from J.P. Morgan and Bank of America.

Serving as evidence that one can in fact have their cake and eat it too, the economy has continued to expand even as inflation has abated. In June 2022, inflation as measured by the Consumer Price Index stood at 9.1 percent. By August 2023, this figure stood meaningfully below 4 percent, though core measures of inflation, which exclude food and energy prices, suggested that inflation was a bit hotter than that. Nonetheless, the pace at which prices are rising has softened markedly. During a recent 12-month period, construction materials prices declined, including in categories like steel, lumber, and crude oil-based products.

The question is why. There are many who would simply give the Federal Reserve credit for the dip in inflation. After all, America’s central bankers have been raising interest rates since March 2022. At that time, the upper limit on the Federal Funds rate, the Federal Reserve’s principal policy instrument stood at 0.25 percent. That same rate ended September 2023 at 5.5 percent. Economists suggest that as interest rates rise, growth slows down and inflationary pressures abate.

It seems so simple. But it is not. There is another explanation for falling inflation – vastly improved supply chains. While many contractors and manufacturers will point out that equipment shortages remain and lead times remain elevated in certain categories, supply chains are meaningfully more dependable than they were in late-2021.

As supply chains normalize and approach complete operability, two things occur. First, pent-up demand is belatedly satisfied, in whole or in part. That results in a profound level of transactional volume. That transactional volume translates into economic growth. Second, as unmet demand is satiated, scarcity abates. That results in less significant price increases and in certain instances outright price declines.

Accordingly, one could theorize that the Federal Reserve’s rate increases have to date had precious little impact on the macroeconomy. Sure, there has been the failure of banks like Silicon Valley Bank (March 10th) and Signature Bank (March 12th) that can be laid at the Federal Reserve’s doorstep, but consider the fact that this has been a period of rising home prices, robust hiring, and equity market gains. That suggests that rate increases to date have not substantially bent the economy’s growth trajectory.

But that can change. As indicated by the highly regarded President and CEO of the Atlanta Federal Reserve Bank, Raphael Bostic, tighter monetary policy can take between 18 months to two years or longer to materially impact inflation. If that is true, then much of the impact associated with higher interest rates has yet to be experienced, and that jeopardizes economic progress.

There are others, however, that would suggest that all of that is hogwash. The economy has enough momentum to power through current and forward-looking high interest rates. As of this writing, the U.S. economy has added approximately 236,000 jobs/month in 2023. Through July, there were 8.8 million available unfilled jobs in America, with nearly 400,000 of them associated with construction and more than half a million associated with the nation’s manufacturing sector. In short, demand for workers remains high. As long as it does, the economy will continue to add jobs and spending power. Many reason that that will suffice to keep inflationary forces at bay.

Looking Ahead

There remain both reasons for hope and reasons for concern. One’s forecast depends upon that which people place emphasis. There is certainly plenty for the glass half-full crowd. At the heart of their optimism is the American consumer, who has manifested an ongoing appetite to travel, shop, and spend thousands on Taylor Swift concert tickets. That consumer is supported by a strong employment market, one that added jobs every month between January 2021 and September 2023 and stands to add more jobs going forward as employers endeavor to fill available positions.

Perhaps nothing encapsulates the strength of the labor market as well as a recently completed deal between UPS and its union. UPS indicates that at by the end of the new five-year contract, the average UPS full-time driver will earn approximately $170,000 annually in pay and benefits.

If that were not enough, America is poised for a wellspring of infrastructure outlays and large-scale manufacturing projects. Industrial policymaking has returned to America, with the federal government subsidizing supply chain formation aggressively using tax credits, including in segments like semiconductor manufacturing, battery production, and inputs to alternative energy like solar panels and wind turbines.

But the glass half-empty crowd has plenty of ammunition, too. While consumers have been spending and employers hiring, a spate of labor unrest threatens future production, including a UAW strike transpiring during the period of this writing. The resumption of student debt repayment also stands to hammer many household balance sheets. Consumers have already amassed more than $1 trillion in outstanding credit card debt, and delinquencies are on the rise.

What is more, the Federal Reserve recently indicated that their rate hiking may not have ended as inflation remains above its 2 percent target. Several significant banks suffered debt downgrades recently from the likes of S&P Global and Moody’s. The upshot is that bank credit is likely to tighten further, rendering project financing more challenging. That could help whittle away at presently lofty backlogs and ultimately push the broader economy into recession at some point over the next year.

More from Modular Advantage

AoRa Development Aims for New York’s First Triple Net Zero Building Using Modular Methods

More cities are providing funding for newer infrastructure projects as long as they meet sustainability requirements. This is how modular can fit the bill, thanks to its lower waste production.

Developers and Designers: Lessons Learned with Modular Design

Modular construction is attractive to many developers because sitework and module construction can occur simultaneously, shortening the schedule and reducing additional costs.

UTILE: Putting Modular Building on a Fast Track

In Quebec, UTILE is taking the lead in creating affordable modular buildings to help decrease the student housing shortage. During the process, the company discovered what it takes to make the transition to modular building a success.

Sobha Modular Teaches Developers How to Think Like Manufacturers

With its 2.7 million square foot factory in UAE, Sobha Modular is bringing both its high-end bathroom pods to high-end residences to Dubai while developing modular projects for the U.S. and Australia.

RoadMasters: Why Early Transport Planning is Make-or-Break in Modular Construction

In modular construction, transportation is often called the “missing link.” While it rarely stops a project outright, poor planning can trigger costly delays, rerouting, and budget overruns.

Navigating Risk in Commercial Real Estate and Modular Construction: Insights from a 44-Year Industry Veteran

Modular projects involve manufacturing, transportation, and on-site assembly. Developers must understand exactly what they are responsible for versus what they subcontract. Risk advisors should research the developer’s contractors, subcontractors, and design-build consultants—especially the modular manufacturer.

Art²Park – A Creative Application of Modular and Conventional Construction

Art²Park is more than a park building—it’s a demonstration of what modular construction can achieve when thoughtfully integrated with traditional materials. The use of shipping containers provided not only speed and sustainability benefits but also a powerful structural core that simplified and strengthened the rest of the building.

Building Smarter: A New Standard in Modular Construction Efficiency

Rising material prices, labour shortages, expensive financing and tightening environmental rules have made conventional construction slower, costlier, and more unpredictable. To keep projects on schedule and within budget, builders are increasingly turning to smarter industrialized methods.

Resia: Breaking All the Rules

Resia Manufacturing, a division of U.S.-based Resia, is now offering prefabricated bathroom and kitchen components to industry partners. Its hybrid fabrication facility produces more precise bathroom and kitchen components (modules) faster and at lower cost than traditional construction. Here’s how Resia Manufacturing does it.

How LINQ Modular Innovates to Bring Modular To The Market in the UAE and Beyond

LINQ Modular, with an office and three manufacturing facilities in Dubai, is a modular firm based in United Arab Emirates. The company is on a mission: to break open the housing and construction markets in the Gulf Cooperation Council (GCC) area with modular.