Modular Construction Reports & Industry Analysis

The Modular Building Institute gathers and distributes statistical information about the size and growth of the modular building industry analysis. These reports have become the leading source of information on the industry and are used worldwide by investment firms, banks, the media, researchers, consultants, and students.

Contents include General Industry Descriptions, Floors Shipped, Gross Sales, Sales by Market Segment, Dealer Gross Revenue, Lease Fleet Composition, Sale of Used Units, Industry Manufacturing Data, Industry Estimates, and Visuals of Contemporary Modular Buildings. Written in a concise fact-filled manner, these reports are full of interesting and helpful information.

2024 Annual Modular Construction Reports

The Modular Building Institute's 2024 Modular Construction Industry Annual Reports are now available! Get the latest and best available information and data showing modular industry trends, growth instigators, and best practices for permanent modular construction and relocatable buildings across North America.

Not a member of the Modular Building Institute? That's okay! Our industry-leading modular industry reports are FREE.

Don't miss out—this data isn't available anywhere else!

Permanent Modular Construction Report

2024 PERMANENT MODULAR CONSTRUCTION REPORT

This market-leading report looks at current drivers and trends of the commercial modular building industry analysis and provides a regional analysis of the North American market. Financial trends and forecasts, environmental impacts, as well as revenue and market share data, are also included.

The 2024 Annual Report for the North American modular construction industry, produced by the Modular Building Institute (MBI), provides comprehensive data on market share, production, and financial performance.

Market Share and Production Data

The report estimates there are 255 modular manufacturing companies in North America. These companies generate a significant portion of their revenue from the modular industry, excluding those focused solely on single-family modular homes or manufactured housing. Approximately 122 of these companies are MBI members.

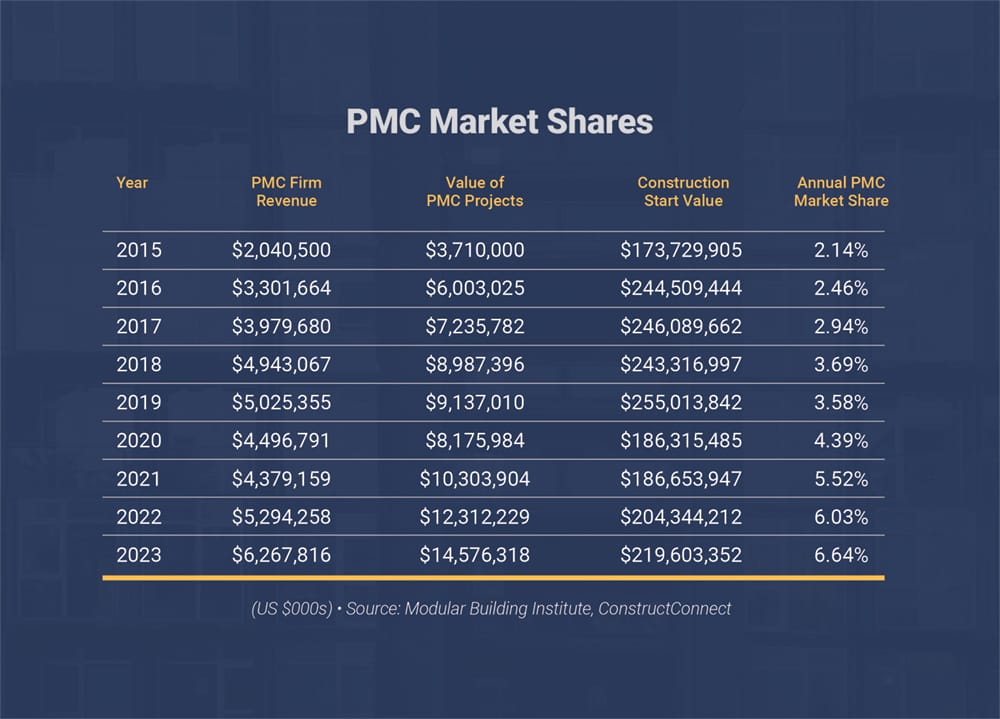

In 2023, the modular industry captured an estimated 6.64% of new construction starts, with a total project value of approximately $14.6 billion. The revenue data collected from 49 North American manufacturers showed an average revenue of $23,474,970 per manufacturer. This revenue represented 43% of the total value of projects utilizing modular construction.

Financial Data

Revenue and market share data have shown consistent growth over the past decade. For instance, in 2015, the market share was 2.14%, with a total value of PMC projects at $3.71 billion. By 2023, these figures had grown to a market share of 6.64% and a total project value of $14.6 billion. This growth underscores the increasing adoption of modular construction techniques across various sectors

Key Markets and Material Usage

The modular construction industry serves multiple markets, including multifamily housing (20%), office buildings including government facilities (18%), educational buildings (15%), retail (11%), and healthcare (6%). The primary materials used in modular construction include wood frames (50%), steel frames (42.9%), and concrete (7.1%). The majority of projects follow the design-bid-build process (78.4%), with others using design-build (10.8%) and public-private partnerships (8.1%).

In short, MBI's 2024 annual report highlights the steady growth and diversification of the modular construction industry in North America, emphasizing its increasing market share, financial robustness, and wide application across various sectors.

Permanent Modular Construction Market Utilization at a Glance

Relocatable Buildings Report

2024 RELOCATABLE BUILDINGS REPORT

This newly-updated report collects the most recent data from the fleet owners around the industry, with new project, revenue, and fleet utilization data. This report also includes valuable information for code compliance and provides an overview of the markets served by the relocatable buildings industry.

The industry consists of approximately 500,000 relocatable buildings, with public school districts operating about 200,000 of these as classrooms, and the industry owning and leasing around 300,000 buildings, representing more than $5 billion in assets.

Markets Served

Relocatable buildings serve diverse markets including education, construction sites, healthcare, general administrative and sales offices, commercial/retail, security, equipment and storage, and emergency and disaster relief.

Market Dynamics

Despite the industry's consolidation, regional competition remains strong due to differences in state building codes and the regionalized nature of the market. Larger companies must compete with smaller, regional fleet owners to meet local demand.

The relocatable buildings industry in North America shows robust financial health and operational efficiency, with significant investments in new inventory and high asset utilization. The market serves a wide range of applications and remains competitive despite industry consolidation. The detailed financial and operational data provided by MBI highlights the growing complexity and adaptability of relocatable buildings to meet various needs across different sectors.

Canadian Modular Industry Report

2024 CANADIAN MODULAR INDUSTRY REPORT

This new report provides an insightful overview of the commercial modular construction industry in Canada, emphasizing market share, production data, and key industry trends.

Industry Trends

The report highlights a significant shift in housing trends, noting a stable number of new housing starts at around 140,000 units, with a marked transition from single-family homes to apartment complexes. This trend was most pronounced in Vancouver, Calgary, and Toronto, whereas Montreal and Edmonton saw a decline in overall apartment construction. The top three markets for 2024-25, as forecasted by Construct Connect, are multifamily, healthcare, and educational facilities, combining for an estimated CAD 33-35 billion annually.

Key Partnerships

MBI’s collaboration with the Canada Mortgage Housing Corporation (CMHC) has been pivotal since 2018, facilitating the revision of underwriting guidelines to better support modular projects. This collaboration has resulted in more than CAD 13.8 billion in new funding for affordable housing in Canada.

In summary, the MBI 2024 report underscores the significant role of modular construction in Canada's housing market, backed by strong economic performance, strategic government initiatives, and an increasing shift towards multifamily housing and other high-demand sectors.

Past Industry Reports

Looking for additional data? MBI's 2023, 2022, and 2021 reports are available below. For older modular construction reports, contact us.

Permanent Modular Construction Reports

Permanent Modular Construction (PMC) is an innovative, sustainable construction delivery method utilizing offsite, lean manufacturing techniques to prefabricate single or multi-story whole building solutions in deliverable module sections. PMC modules can be integrated into site built projects or stand alone as a turn-key solution and can be delivered with MEP, fixtures and interior finishes in less time—with less waste, and higher quality control compared to projects utilizing only site-built construction. Recent research on modular building construction analysis has come out supporting the fact that modular construction is an efficient construction process and poised to help the construction industry grow.

Relocatable Buildings Reports

A Relocatable Building (RB) is a partially or completely assembled building that complies with applicable codes or state regulations and is constructed in a building manufacturing facility using a modular construction process. Relocatable buildings are designed to be reused or repurposed multiple times and transported to different building sites. They are utilized for schools, construction site offices, medical clinics, sales centers, and in any application where a relocatable building can meet a temporary space need. These buildings offer fast delivery, ease of relocation, low-cost reconfiguration, accelerated depreciation schedules and enormous flexibility. Relocatable buildings are not permanently affixed to real estate but are installed in accordance with manufacturer’s installation guidelines and local code requirements. These buildings are essential in cases where speed, temporary space, and the ability to relocate are necessary.

Canadian Commercial Modular Construction Reports

NEW 2024 Canadian Market Report Now Available!

In 2019, MBI represented 60 companies based in Canada, including 26 manufacturers of modular structures. MBI estimated that there are about a total of 45 modular manufacturers in Canada fabricating for a variety of markets including residential, multi-family, commercial, educational, and industrial sectors. There were also an estimated 15 or so smaller fabrication warehouses doing renovations and modifications for various markets. This report details in the entire modular industry analysis—permanent modular construction and relocatable buildings—in Canada.

![Trane-ME-primary-(2)[3]_560x166 Trane-ME-primary-(2)[3]_560x166](https://growthzonecmsprodeastus.azureedge.net/sites/1933/2022/03/Trane-ME-primary-23_560x166-f7906ac1-5850-4fc5-89ee-e7867ffc4393.png)